Convenient

Apply anytime, anywhere, with just one document required.

Apply anytime, anywhere, with just one document required.

Your data is secure, and we’re here to support you during tough times.

Simple and hassle-free processes, completed in minutes from the comfort of your home.

Complete a simple form in our app to send in the loan application easily.

Sit tight—our approval process typically takes just 15 minutes.

Once approved, your funds will be transferred, often within a minute!

Send in your loan application using our app by filling out a quick form.

Download loan app

Accessing financial assistance in Nigeria has become significantly easier with the introduction of loans that require only a Bank Verification Number (BVN). A loan with BVN only allows individuals to secure funds without the need for extensive documentation or collateral, making it a popular choice for many Nigerians seeking quick and reliable financial solutions. This streamlined approach leverages the BVN as a unique identifier, simplifying the loan application process and making it more accessible to a broader audience.

Choosing a loan that requires only your BVN comes with numerous advantages, catering to various financial needs:

In today's fast-paced world, financial emergencies can arise unexpectedly, requiring immediate attention. A 5 minute online loan is designed to address such urgent needs by providing a seamless digital application process. With just a few clicks, borrowers can apply for and receive funds almost instantly, making it an ideal solution for immediate financial challenges. This type of loan leverages technology and BVN verification to ensure that funds are disbursed quickly, bridging the gap between urgent financial needs and available resources.

The demand for instant loans in Nigeria has grown significantly as more people seek efficient ways to manage their finances. Whether it's for covering unexpected medical expenses, handling emergency repairs, or seizing a business opportunity, instant loans offer the necessary support without the delays often associated with traditional banking. The immediacy provided by instant loans is crucial in a fast-paced economy where time is of the essence, allowing individuals to address their financial needs promptly and effectively.

While BVN-based loans are popular, some individuals may prefer not to use their BVN or may not have one. A quick loan without BVN provides an alternative, allowing borrowers to access funds without revealing their BVN. These loans typically require alternative forms of identification, ensuring that borrowers can still receive financial assistance promptly. This option is particularly beneficial for those who value their privacy or do not have access to a BVN, expanding the accessibility of financial services to a wider audience.

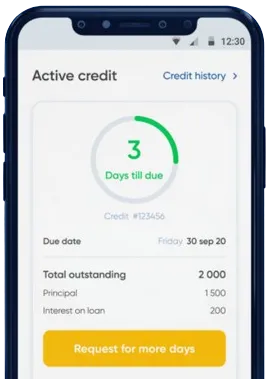

The rise of mobile technology has led to the development of various apps to borrow money in Nigeria. These applications offer a convenient way to apply for loans directly from your smartphone, eliminating the need to visit a physical bank or financial institution. Key features of these apps include:

This level of convenience and accessibility makes borrowing money easier and more efficient for users across the country.

Among the numerous loan apps available, finding the best loan app without BVN can be challenging. The top apps in this category prioritize user privacy and offer alternative verification methods, such as using the National Identification Number (NIN) or other forms of ID. These apps ensure a secure and efficient borrowing experience without the need for BVN, making them an excellent choice for individuals who prefer not to use their BVN or do not have one. By providing reliable services and maintaining high security standards, the best loan apps without BVN cater to a diverse range of borrowers.

Sometimes, financial needs arise unexpectedly and require immediate attention. An urgent loan in Nigeria is specifically designed to provide quick financial assistance for such situations. Whether it's an emergency medical bill, a sudden home repair, or an unexpected travel expense, urgent loans ensure that you have the funds you need without unnecessary delays. The focus is on speed and convenience, allowing borrowers to navigate financial crises efficiently and with minimal stress.

In addition to BVN-based loans, some lenders offer loans that require only a National Identification Number (NIN). A loan with NIN only broadens access to financial services for individuals who may not have a BVN or prefer using their NIN for verification. This option ensures that more Nigerians can benefit from accessible and flexible loan options, providing an alternative pathway to secure funds without the mandatory use of BVN. By accommodating different forms of identification, lenders can serve a wider demographic and address the diverse needs of the population.

Benefits of a Loan with NIN Only include:

If you prefer not to use your BVN when borrowing money, there are several apps to borrow money without BVN available. These apps utilize alternative verification methods, such as NIN or other identification forms, allowing you to access funds securely and efficiently without compromising your BVN. This flexibility is particularly appealing to individuals who value their privacy or do not have access to a BVN, ensuring that everyone has the opportunity to obtain the financial assistance they need through secure and user-friendly digital platforms.

Privacy is a significant concern for many borrowers. If you wish to remove your BVN from a loan app, here's how you can do it:

First, access the app settings by opening the loan app and navigating to the privacy or account settings section. Look for an option to delete or remove your BVN and follow the on-screen instructions. If the option isn't available directly within the app, reach out to the app's customer service for assistance. Finally, ensure that you receive confirmation once your BVN has been successfully removed from the app's records. Always review the app's privacy policy to understand how your data is handled and the implications of removing your BVN.

For those who either do not have a BVN or prefer not to use it, an online loan in Nigeria without BVN offers a practical solution. These loans provide the same benefits as BVN-based loans, such as quick access to funds and flexible repayment options, but use alternative verification methods to approve your application. This inclusivity ensures that a broader audience can access financial support without the mandatory use of BVN, making financial services more accessible to all Nigerians regardless of their identification status.

If you are thinking how to choose the app that can borrow me money it is crucial for a smooth borrowing experience. When choosing an app, consider the following factors:

By carefully evaluating these aspects, you can choose an online loan app that best fits your needs and ensures a secure and efficient borrowing experience.

Loans that require only a BVN are revolutionizing the way Nigerians access financial services. By simplifying the application process and eliminating the need for extensive documentation or collateral, a loan with BVN only offers a convenient and accessible solution for various financial needs. Whether you need a 5 minute online loan, an instant loan in Nigeria, or prefer a quick loan without BVN, there are numerous options available to suit your specific requirements.

Additionally, with the emergence of specialized apps like the best loan app without BVN and platforms that allow you to borrow money without BVN, obtaining an urgent loan in Nigeria has never been easier. Understanding these options empowers you to make informed financial decisions, ensuring that you can navigate your financial challenges with confidence and ease.

A loan with BVN only allows you to secure funds using your Bank Verification Number as the primary identification, without requiring extensive documentation or collateral.

Benefits include a quick application process, minimal documentation, swift disbursement, no collateral requirements, flexible repayment options, and accessibility for those without traditional IDs.

Yes, some lenders offer quick loans without requiring a BVN. These loans typically use alternative forms of identification, such as a National Identification Number (NIN), ensuring access for more borrowers.

A 5-minute online loan is a digital financial solution that allows borrowers to apply and receive funds almost instantly, using BVN for quick verification.

To remove your BVN, navigate to the app's settings and look for an option to delete it. If unavailable, contact customer service for assistance and request confirmation of the removal.

Yes, various loan apps in Nigeria allow users to borrow money quickly and conveniently. Some apps also offer loans without requiring a BVN, using alternative verification methods.

A loan with NIN only allows borrowers to access funds using their National Identification Number instead of a BVN, broadening access to financial services.

Consider the app's reputation, transparency in terms, customer support, user-friendly interface, and strong security measures to ensure a safe and efficient borrowing experience.